All About E-Commerce & TCS Compliance under GST Regime

As per the CGST Act, e-Commerce Operators (a.k.a. Marketplaces) should obtain a GSTIN called E-Commerce Operator GSTIN in every state in which they have registered merchants. This is different from a normal GSTIN though it looks like a Regular GSTIN number; it will be having letter C as the 14th letter while regular GSTIN would be having Z as the 14th letter.

Marketplaces will collect 1% on IGST or 0.5% on CGST plus 0.5% SGST as TCS depending on whether the transaction is Inter-state or Intra-state. And, they should file GSTR-8 in all states from which they have registered sellers & deposit the TCS collected under each merchant’s GSTIN Number. Once they file GSTR-8, it will be displayed in GSTR-2A of Sellers GSTIN login under Part-C > TCS Creditssection for each month. Marketplaces would be reporting Gross Sales & Returns, NET Taxable Value liable to collect TCS along with the TCS collected against IGST, CGST & SGST every month.

e-Commerce Operators/Marketplaces should deduct 1% TCS of the NET Taxable Value of sales when they make the payments to the Sellers as per their Payment Settlement terms. Hence, we must be seeing a deduction of TCS in our Payment Settlement report. And, they should pay the same amount collected under TCS on behalf of the seller to the Govt when they file the GSTR-8 return for the month.

The NET Taxable value would be calculated as the Total of Taxable value for the sale happened during the current month minus the Total of Taxable value for the returns received during the month. Returns received in a particulate month can be for the sale happened during the same month itself or for a sale happened during one of the previous months.

Which means, the NET Taxable Sales value reported by Marketplaces under GSTR-8 would always be lesser than the NET Sales figures posted by us when we file GSTR-1, at least for the month of Oct 2018 and for a couple of months thereafter. This is because we adjust the NET value of the Returns we received for a Sale prior to TCS against the Sales Value in the current month after TCS.

How to validate the NET Sales figures from Sales Reports with the value reported by Marketplaces in TCS Return?

When we consolidate the NET Sales for a specific month, we would always consider NET sales happened during the current month & the NET returns received in the current month. Which means, we can very well receive a return for a sale happened prior to 01 Oct 2018 as well.

Let’s define the details as below.

(1) NET Taxable Value of Sales for the Current Month

(2) NET Taxable Value of Returns received for orders after 01 Oct 2018

(3) NET Taxable Value of Returns received for orders before 01 Oct 2018

NET of Turnover as per GSTR-1 = (1) – (2) – (3)

NET of Turnover posted by Marketplaces = (1) – (2)

This means that we will always see an inflated Taxable value for Sales posted in TCS Returns by marketplaces, at least for the initial few months until (3) becomes Zero.

Additional Registration Requirements for e-Commerce Sellers?

NO additional registration requirements for the Individual eCommerce Merchants with regards to TCS. But, marketplaces must register for E-Commerce Operator GSTIN registration in all state where they have Registered Sellers selling on the platform. Which means that the marketplaces must register in all 36 States & Union Territories of India to obtain an E-Commerce Operator GSTIN number for filing TCS.

Of course, all eCommerce Sellers MUST obtain GST Registration to sell through e-Commerce marketplace irrespective of the turnover. The generic exemption of Rs. 20L turnover does not apply to e-Commerce Sellers, unfortunately.

When, Where & How we can find out the Data filed by Marketplaces in GSTR-8 Return?

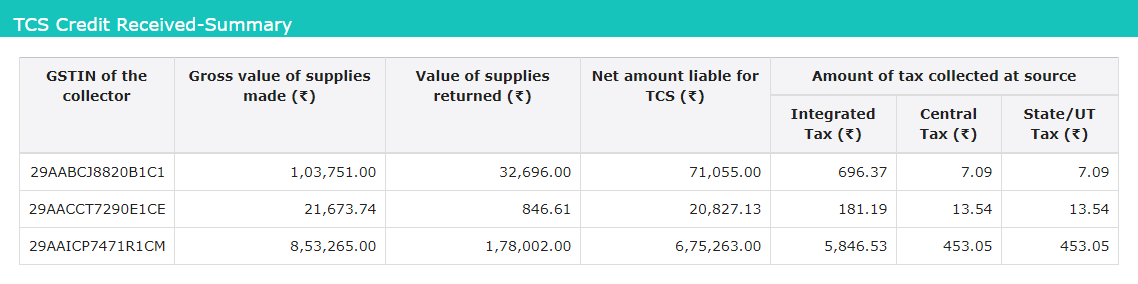

Marketplaces should file GSTR-8 on or before the 10th of the next month. Once the return is filed by the Marketplaces, it will start appearing in GSTR-2A > Part-C > TCS Credits Section like the one shown below.

How to Claim the TCS Credits?

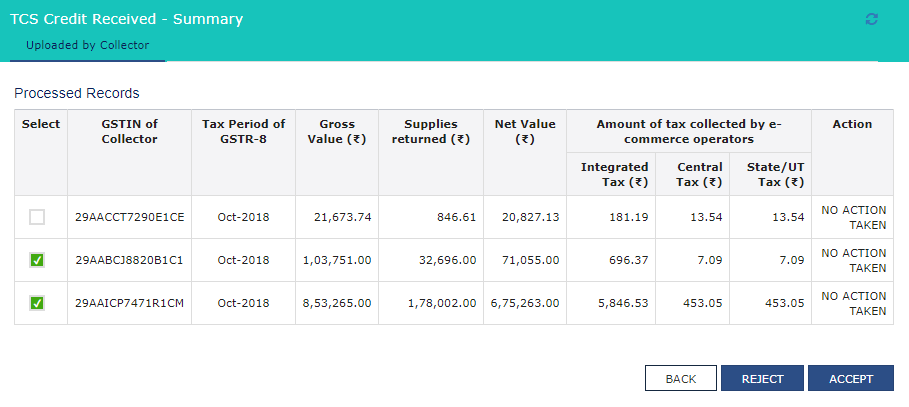

Once Marketplaces file GSTR-8 Return, it will come under “TDS & TCS Credits Received” section of Return Dashboard. To view and act on it, you should navigate to Return Dashboard > Search for the Current Month > TDS & TCS Credits Received > Prepare Online > TDS Credits Received section to view it & act on it. The section will look like below.

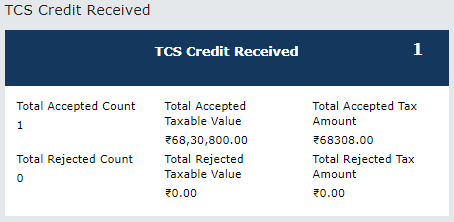

You will have 2 actions available here. You can either Accept or Reject the filing by the marketplaces (These options were grayed out until now & it is not open for our action). Things are not clear on what happens when you reject the numbers filed by e-Commerce marketplaces (please expect an update on this later). If all data filed by marketplaces are fine and acceptable to us, you can select them & Click on Accept to mark your agreement. Once you Accept/Reject the filings and generate the Summary for filing, the “TDS & TCS Credits Received” section will look like this.

Once you have at least one entry in Accepted/Rejected status, you will be able to generate the Summary file for Filing & the option to “FILE TDS TCS CREDITS RECEIVED” button will get enabled. As per theory, we should see it in Electronic Cash Ledger once Marketplaces files GSTR-8 which does not seem to be True. It looks like we need to file “TDS & TCS Credits Received” Return to reflect the TCS Amount in Electronic Cash Ledger. And, the same should ideally flow to “Section 6.2 TDS/TCS Credit Received” of GSTR-3B for us to claim it.

I will update the article with the complete details once I could complete the GST Return filing Workflow (practically) for the month of Oct 2018. Unfortunately, this is the first time we’re doing this and we can only follow the ‘Trial & Error’ method of doing things considering the delay/lack of timely response from GST Authorities & Marketplaces.

Changes in GSTR-1 Filing Process after TCS

Until the GSTR returns for the month of Sept 2018, we were reporting e-Commerce sales under “Other than E-Commerce (OE)”. As per theory, we should start reporting the e-Commerce Sales from Oct 2018 onwards as the sales under E-Commerce (EC) itself instead of reporting it under Other than E-Commerce (OE), by quoting E-Commerce Operator GSTIN of each marketplace. Which means, we should start reporting Sales in GSTR-1 with State-wise, GST Rate-wise & Marketplace-wise numbers.

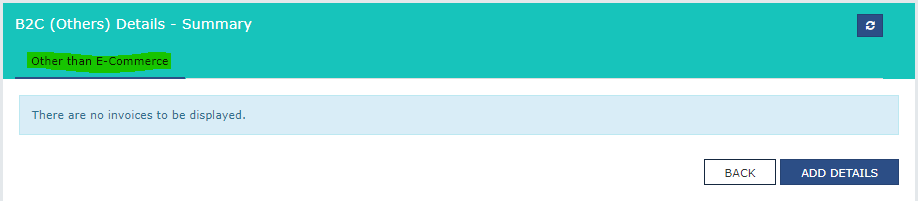

Unfortunately, GST Return Filing workflow is not yet equipped with an option to report the sales under E-Commerce (EC) using E-Commerce operator GSTIN of each marketplace.

As per theory, we should report sales marketplace-wise as well to match it with the TCS Reporting by marketplaces under GSTR-8. Which means, we may have to wait to see another tab to appear for “E-Commerce” to enter sales figures via Prepare Online mode for GSTR-1.

Can we claim TCS Collected as Refund if we could not offset it against Output GST?

It is very well possible to have a scenario where you won’t be able to offset TCS against your Output GST. In most cases where there is an Inverted Tax Structure or if there is an Export income, you might be having excess ITC (Input Tax Credit) accumulated in your Electronic Credit Ledger. In that case, you will never be able to utilize the TCS Collected by Marketplaces for paying Output GST.

As per the Process workflow, TCS will finally flow into Electronic Cash Ledger unlike Input Tax Credit (ITC). As of now, we can get a refund of cash accumulated in Electronic Cash Ledger under GST RFD-01A as well, apart from the cases mentioned in here. As of now, the amount in Cash Ledger will appear when we make a wrong/excess payment while paying Challan for offsetting the Output liability, which is refundable now. Going forward, TCS will come into Electronic Cash Ledger & I presume that we should be able to Claim a Refund of TCS Amount collected if we are unable to consume it for paying output GST. I will update the article once I have a clear & practical understanding of the Refund workflow in case of Accumulated TCS.

Related Articles

GST rates reduction on several items - Guidelines to Amazon Sellers

GST council has recommended GST rates reduction on several items which are effective July 27, 2018. It is important for you to know the process for updating the GST rates (also referred as Product Tax Code – PTC* in your Seller Central Account) ...E-mailing Invoice Mandatory for Amazon Inbound Pickup Service (ATS)

For FBA shipments sent through Amazon Inbound Pickup Service (ATS), the invoice must be e-mailed by you to Amazon at in-aips-invoice@amazon.com, one day prior to scheduled pickup date. Invoice Guidelines --------------------- The invoice must ...GENERATING YOUR GSTR-1 REPORT FROM EVANIK OWS

Your eVanik OWS has prebuilt GSTR-1 Reports. Login to your OWS Account, and follow the steps below: 1. Click on the Menu Button and scroll down to "Reports" Section. Click on "Reports" Menu 2. Select the Menu "Export Reports" 3. Select the Date Range ...Why are emails being bounced back by my buyer's e-mail service provider?

There could be many reasons why emails are being bounced back on Seller Central, the most common ones would be if your buyer's inbox is full or if they signed up to Amazon with a non-valid email address for example. When this happens, feedBAKER would ...Handling Commission Entries in Tally through eVanik OneWorld Suite

Commission Fee Handling in Tally. ERP9 All marketplaces charge a fee from sellers for selling products on their platform. There are 2 separate documents through which a seller gets to know what fees / charges / commissions are being deducted by the ...